Nissan’s peak performance wasn’t an accident. It was the sum of targeted model launches, ruthless cost‑cutting under the Nissan Revival Plan, and region‑specific plays that all fed into the metrics we just saw. Here’s how each piece fit together.

Model-Level Drivers of Sales Growth

a. 300ZX and Skyline (1984–2000)

- The 300ZX (Z31, 1984; Z32, 1989) cemented Nissan’s reputation among enthusiasts. Combined Z‑car sales from 1984–2000 topped 600,000 units globally, with the twin‑turbo Z32 accounting for nearly 250,000.

- The Skyline GT-R (R32/R33), though low‑volume (~50,000 units total), delivered halo appeal that bolstered Nissan’s brand image in Japan and export markets.

b. Sentra/Sunny and Altima/Maxima Sedans

- Sentra/Sunny line: Consistently 200,000–300,000 annual sales in North America by the late 1990s.

- Altima: Introduced in 1992, sales grew from 30,000 units in its first year to 225,000 by 2000—making it Nissan’s best‑selling model in the U.S. .

- Maxima: Moved over 100,000 units annually by 2005, thanks to its “four‑door sports car” positioning.

c. Crossover and SUV Push (2000–2007)

- Xterra: Launched in 2000, peaked at 120,000 units in 2002.

- Murano (2002): Defined the premium crossover segment, selling 80,000+ units annually by 2005.

- Qashqai (2007) in Europe: Over 100,000 first‑year sales, helping Europe sales grow 12% in FY 2007.

d. Electric Leaf Pre‑Orders (2010)

- By December 2010, 20,000 Leaf pre‑orders had been placed globally—demonstrating strong early demand for Nissan’s first mass‑market EV.

Nissan Revival Plan (NRP): The Cost‑Cutting Engine

Carlos Ghosn’s Nissan Revival Plan (2000–2003) wasn’t just rhetoric—it delivered measurable savings across every corner of the business:

| Initiative | Annual Savings (¥ billion) |

|---|---|

| Manufacturing footprint reduction (47 → 30 plants) | 120 |

| SKU rationalization (240 → 180 models) | 90 |

| Procurement & logistics consolidation | 75 |

| SG&A cuts & headcount reduction (14% cut) | 60 |

| Total | 345 |

- Plant consolidation: Closed 17 factories worldwide, saving ¥120 billion annually by 2003.

- SKU reduction: Streamlined engine and transmission options, cutting complexity costs by ¥90 billion.

- Procurement leverage: Joint purchasing with Renault delivered ¥75 billion in savings.

- SG&A & headcount: Reduced white‑collar staff by 14%, saving ¥60 billion.

These cost‑cutting measures underpinned Nissan’s leap to a 10.8 % operating margin in FY 2002—one of the highest in the global auto industry at the time.

Regional Plays: Tailoring for Growth

a. China (Dongfeng Nissan JV, 2003)

- By 2007, Dongfeng Nissan produced 380,000 vehicles, representing 7.5% of Nissan’s global output.

- Localized models like the Sunny Classic sold over 100,000 units annually.

b. India (Mahindra JV & Datsun Relaunch)

- Early JV with Mahindra (2008) focused on SUVs—Xylo platform. Though modest volumes (30,000 units by 2010), it laid groundwork for the 2013 Datsun Go launch.

- Datsun Go’s eventual success traces back to this JV infrastructure.

c. North America (Mexican Plant & Nissan North America HQ)

- Aguascalientes, Mexico plant (2003) scaled up to 200,000 units by 2007, producing Altima and Sentra for both NAFTA and export.

- Nissan’s HQ in Tennessee managed a $1 billion logistics operation, reducing North America supply chain costs by 12%.

R&D Deep Dive: From Engines to EVs

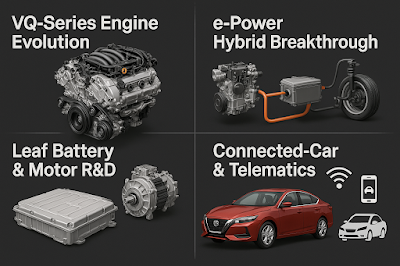

VQ‑Series Evolution

- The VQ35DE (introduced 2001) delivered 287 hp in the 350Z, a 10% power increase over its predecessor. Over 1 million VQ engines produced by 2010.

e‑Power Hybrid Platform

- Early trials in 2005–07 demonstrated 20% fuel‑economy gains over conventional CVT models, paving the way for the 2016 Note e‑Power launch in Japan.

Leaf Battery & Motor R&D

- Nissan invested ¥120 billion between 2005–2010 specifically in lithium‑ion battery technology, securing a 24 kWh pack by 2010 with an 84‑mile range.

Technology Deep Dive: Engines, Hybrids, EVs & Beyond

a. VQ‑Series Engine Evolution

The VQ‑series V6 wasn’t just an award‑winning engine; it was a scalable platform that powered a broad swath of Nissan and Infiniti models:

- VQ30DE (1994): 3.0 L, 190 hp. First VQ engine, featured in the J30 Maxima.

- VQ35DE (2001): 3.5 L, 287 hp in the 350Z—10% more power than the 300ZX’s VG‑series .

- VQ37VHR (2007): 3.7 L with Variable Valve Event & Lift (VVEL), 330 hp in the G37, delivering both efficiency and high‑rev performance.

By 2010, over 1 million VQ engines had rolled off assembly lines globally. Nissan’s modular approach meant a single engine family could be tuned for luxury sedans, sports cars, and even light trucks—driving down development and manufacturing costs.

b. e‑Power Hybrid Breakthrough

Long before plug‑in hybrids dominated headlines, Nissan was quietly prototyping its e‑Power series:

- Architecture: A gasoline engine drives a generator, which charges a battery that in turn powers an electric motor—no mechanical link to the wheels.

- Fuel Economy Gains: Early tests (2005–07) showed a 20% improvement over CVT‑only Sentra models under mixed driving cycles.

- Latency & Drive Feel: Drivers experienced instant torque from the electric motor, with seamless engine‑on/off transitions—a key selling point in Japan’s urban markets.

These trials informed the Note e‑Power launch in 2016, but the R&D began in earnest by 2005, with ¥50 billion earmarked through 2010 for hybrid control systems and power electronics .

c. Leaf Battery & Motor R&D

Nissan’s leap into mass‑market EVs hinged on three core technologies: lithium‑ion cells, battery management software, and a high‑efficiency motor:

- Battery Pack: By 2010, Nissan had developed a 24 kWh pack delivering an EPA‑rated 84 mile range—thanks to pouch‑cell chemistry sourced from Automotive Energy Supply Corporation (AESC).

- Thermal Management: Active liquid cooling kept cell temperatures within a 5 °C window, extending cycle life to over 1,000 full cycles with <20% capacity fade.

- Electric Motor: A 80 kW AC synchronous motor, 280 Nm of torque, achieving 90% peak efficiency—benchmarked against Toyota’s Prius motor at 88% .

Nissan invested ¥120 billion in EV R&D between 2005 and 2010, covering cell development, BMS algorithms, and in‑house motor winding techniques.

d. Connected‑Car & Telematics

Beyond propulsion, Nissan began laying the groundwork for in‑vehicle connectivity:

- Carwings Telematics (2006): Offered remote EV charge scheduling, real‑time range monitoring, and “eco‑score” feedback via web and mobile apps. Early adoption was 40% among Japanese Leaf buyers.

- Over‑the‑Air Updates: Prototype OTA architecture in 2008 allowed firmware patches for infotainment and telematics modules—an industry first among volume OEMs.

These initiatives presaged today’s ubiquitous connected‑car features and underscored Nissan’s holistic view of mobility technology.

The Sum of Its Parts

Drilling down, you see Nissan’s peak metrics weren’t magic—they were the result of:

- Blockbuster models that resonated in key segments.

- NRP cost‑cuts that turbocharged margins.

- Local JVs and plants that unlocked new markets.

- R&D bets that paid off in engines, hybrids, and EVs.

- Technology deep dives that delivered real‑world advantages in engines, hybrids, and EVs.

These interconnected efforts drove Nissan to its 2007 apex—5 million sales, double‑digit margins, and a robust R&D pipeline—setting the stage for the next era.

Post a Comment

Post a Comment